Nebius, a full-stack AI company, has recently secured $1 billion in funding to advance its AI cloud platform. This significant investment highlights the growing confidence in Nebius’s vision and capabilities within the rapidly expanding AI industry. With a focus on providing comprehensive infrastructure solutions, including large-scale GPU clusters and AI-native cloud services, Nebius aims to empower AI developers and researchers worldwide.

This article delves into the details of Nebius’s recent funding round, its strategic plans for utilizing the capital, and the potential implications for investors and the broader AI landscape. We will explore whether Nebius, potentially represented by ‘NBIS’ in stock market discussions, is a promising investment opportunity, considering its ambitious growth targets and competitive differentiators. Additionally, we will analyze the key factors that could influence the company’s performance and future prospects.

Nebius Secures $1 Billion to Accelerate AI Cloud Platform

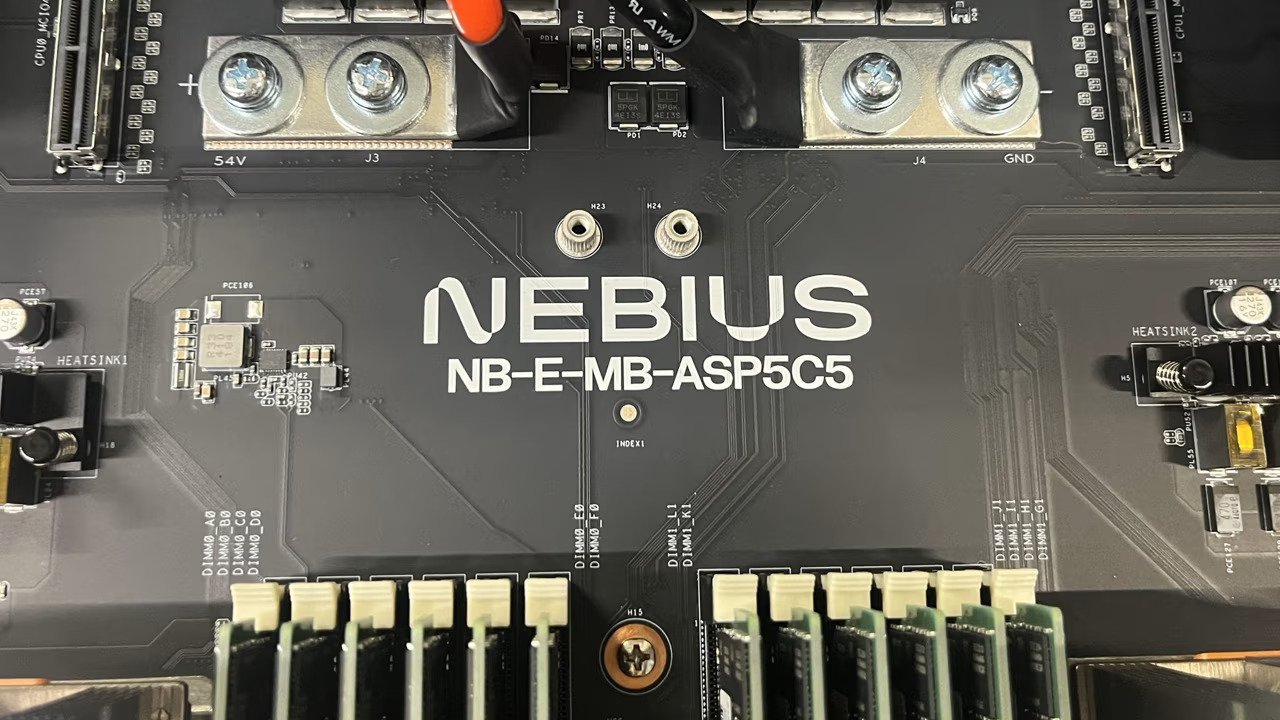

Nebius Group’s recent acquisition of $1 billion in convertible notes signifies a pivotal moment in its journey to dominate the AI infrastructure space. This substantial financial injection will enable Nebius to aggressively expand its compute power, extend its data center footprint, and pursue other strategic initiatives. The company’s commitment to in-house hardware design and proprietary cloud software architecture underscores its dedication to providing optimized solutions for AI and ML workloads.

According to Arkady Volozh, founder and CEO of Nebius, this funding round reinforces the investment community’s belief in the company’s business model and growth potential. Since securing $700 million in equity financing in December 2024, Nebius has been scaling rapidly, and this new capital infusion will further accelerate its progress toward achieving its ambitious revenue targets. The company aims to reach mid-single-digit billions of dollars in revenue as a high-margin business, with potential upside.

Nebius’s AI-Centric Cloud Platform and Diverse Ventures

At the heart of Nebius’s operations lies its AI-centric cloud platform, specifically engineered for intensive AI/ML workloads. This platform offers AI and ML practitioners the essential compute, storage, managed services, and tools needed to build, fine-tune, and deploy their models efficiently. The company’s focus on in-house hardware design, including servers, racks, and data center infrastructure, sets it apart from competitors and allows for greater control over performance and optimization.

In addition to its core cloud platform, Nebius Group operates three additional businesses under distinct brands. These include a data partner for AI development, one of the world’s most experienced self-driving teams, and a leading edtech platform specializing in reskilling individuals for tech careers. Nebius Group also holds equity stakes in other businesses, including ClickHouse and Toloka, an AI data solutions business.

Arkady Volozh’s Vision for Nebius’s Future Growth

Arkady Volozh, the founder and CEO of Nebius, has articulated a clear vision for the company’s future growth and strategic direction. He emphasizes that Nebius’s non-core assets and equity stakes with significant growth profiles can be leveraged to support the future funding requirements of its business. This approach allows the company to maintain a strong balance sheet and minimize shareholder dilution while investing in its core business.

Volozh believes that Nebius’s disciplined approach to capital allocation and its focus on revenue growth will translate efficiently into bottom-line results. This competitive differentiation should enable the company to deploy billions of additional capital to support its hypergrowth plans while remaining disciplined on leverage. Nebius Group intends to allocate the net proceeds from the issuance of the Notes to finance the continuing growth of its business, including the acquisition of additional compute power, the expansion of its data center footprint, and for general corporate purposes.

Is NBIS Stock a Buy? Analyzing Nebius’s Potential

The question on many investors’ minds is whether NBIS stock, if it represents Nebius Group, is a worthwhile investment. Several factors should be considered when evaluating this opportunity. Nebius’s strong financial position, its focus on a high-growth market, and its strategic investments in AI infrastructure and related businesses are all positive indicators. However, it’s crucial to conduct thorough due diligence and assess the risks associated with investing in a rapidly evolving industry.

Investors should closely monitor Nebius’s progress in achieving its revenue targets, expanding its customer base, and maintaining its competitive edge in the AI cloud platform market. Analyzing the company’s financial statements, industry reports, and expert opinions can provide valuable insights into its potential for long-term success. Additionally, staying informed about the latest developments in the AI industry and the competitive landscape is essential for making informed investment decisions.

Navigating NBIS Stock Discussions and Forums

Online forums and communities dedicated to stock market discussions can provide valuable insights and perspectives on NBIS stock. However, it’s important to approach these sources with caution and critical thinking. While forums can offer a platform for sharing information and opinions, they may also contain misinformation or biased viewpoints. Investors should conduct their own independent research and consult with financial professionals before making any investment decisions.

When participating in NBIS stock forums, focus on gathering factual information, analyzing different perspectives, and evaluating the credibility of the sources. Be wary of overly optimistic or pessimistic claims and always verify information with reputable sources. Remember that investing in the stock market involves risk, and there are no guarantees of returns. A well-informed and disciplined approach is essential for achieving long-term investment success.

Conclusion: Nebius’s $1B Funding and the Future of NBIS Stock

Nebius’s recent success in securing $1 billion in funding underscores the company’s strong position in the AI infrastructure market and its potential for future growth. With a clear strategic vision, a focus on innovation, and a commitment to providing comprehensive solutions for AI developers, Nebius is well-positioned to capitalize on the rapidly expanding AI industry. However, investors should carefully evaluate the risks and opportunities associated with NBIS stock before making any investment decisions.

By conducting thorough research, analyzing industry trends, and consulting with financial professionals, investors can make informed choices that align with their investment goals and risk tolerance. Nebius’s journey to become a leading provider of AI cloud infrastructure is just beginning, and the company’s future success will depend on its ability to execute its strategic plans, adapt to changing market conditions, and maintain its competitive edge. As the AI industry continues to evolve, Nebius and NBIS stock will undoubtedly remain subjects of interest for investors and industry observers alike.

Leave a Reply