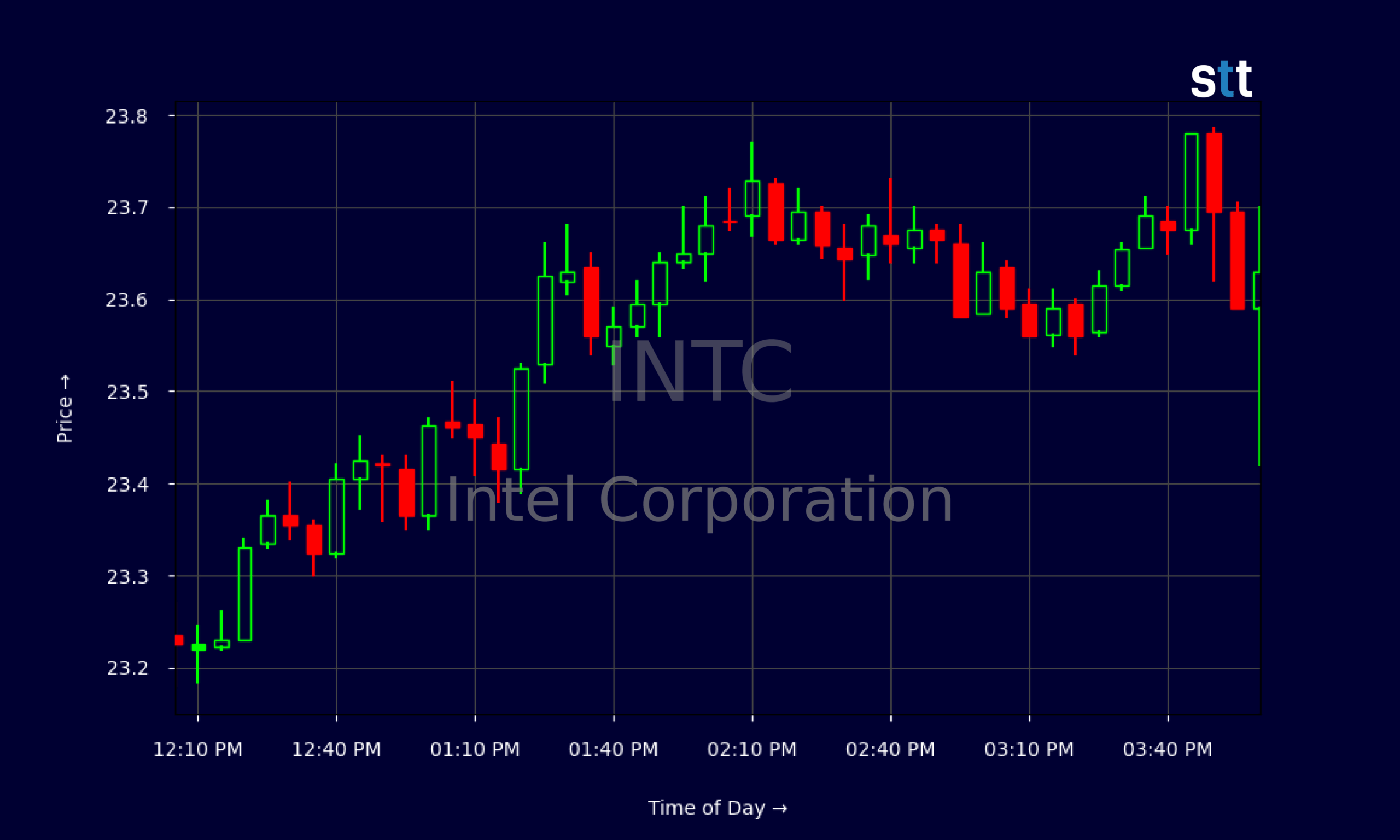

Intel Corporation [NASDAQ: INTC] has recently seen a significant uptick in its stock value, driven by promising advancements in chip technology and positive sentiments surrounding US-China trade discussions. As of July 8, 2025, Intel’s stock is trending up by 7.86%, capturing the attention of investors and traders alike. This article delves into the key factors propelling this market movement, offering an expert analysis of Intel’s financial standing, strategic decisions, and future prospects.

The analysis will cover Intel’s Q1 2025 financial performance, including revenue, gross margin, and debt management strategies. We will also explore how Intel’s stock dynamics are influenced by international policy changes and strategic pivots, such as the potential shift from 18A chip technology to the more advanced 14A. Understanding these elements is crucial for traders looking to capitalize on market trends and make informed decisions.

Finally, the article will address the importance of visible momentum in trading, as emphasized by Tim Bohen, lead trainer with StocksToTrade, and what this means for Intel’s future trajectory. The days following July’s earnings release will be critical in determining whether Intel’s market movements represent temporary surges or herald long-term stability.

Recent Developments

Intel has been making headlines with several key developments that are impacting its market position:

- Q2 2025 Financial Results: Intel is set to release its Q2 2025 financial results on July 24, 2025, followed by an earnings conference. This webcast event is highly anticipated by the global investor community.

- Leadership Shifts: With Greg Ernst stepping in as the chief revenue officer, Intel aims to enhance its engineering expertise and client relations.

- US-China Trade Talks: Promising reports on US-China trade talks have positively influenced the markets, with Intel experiencing an 8% rise in share value, leading S&P 500 gains.

- Potential Tax Credits: Discussions around potential changes in US tax credits for tech manufacturers hint at a possible 30% benefit for Intel.

- Strategic Shift: Intel is considering halting its 18A chip tech sale to focus on the more advanced 14A, aiming to surpass TSM.

Financial Overview: Intel on a Fiscal Frontier

Intel’s Q1 2025 performance revealed a revenue of $53.10 billion and a gross margin of 31.7%. However, the company reported a net loss, primarily due to significant debt and interest expenses. The EBITDA margin was a slim 2.4%, indicating an ongoing struggle to bolster operating profits. The pretax profit margin stood at 12.9%, reflecting adversities faced in global semiconductor markets.

Debt analysis shows a total debt to equity ratio of 0.5, with a current ratio of 1.3, suggesting Intel can manage its short-term liabilities. The chipmaker’s leverage ratio is at 1.9, indicating a need to focus on long-term debt reduction initiatives. With an interest coverage ratio of just 2.1, investors may be concerned about Intel’s debt management strategies.

Intel’s total turnover rate remains lean at 0.3, pointing to potential improvements in asset efficiency. The receivables turnover is high at 16.6, while inventory turnover trails at 3.1. Despite these challenges, Intel is making capital investments with new strategic directions. Innovations and a continuous focus on microchip advancements indicate potential growth, though investors may remain watchful.

Stock Dynamics: Analyzing the Financial Crossroads

Intel’s shares have soared, largely driven by positive sentiments around trade discussions between the U.S. and China. This surge, exceeding an 8% increase, positions Intel as a frontrunner on the S&P 500. Such shifts offer a glimpse into investor hopes for stabilizing trade relations, which are crucial for tech stocks like Intel.

Market elasticity to international policy changes, such as proposed tax credit increases, further fuels optimism. This governmental discourse heralds opportunities for tech manufacturers like Intel, as they prepare to tap into elevated tax allowances aimed at bolstering local tech production. By doing so, Intel plans to leverage these tax benefits and channel this momentum for broader competitive advances in silicon prowess.

Intel’s consideration to pivot from the 18A chip strategy underscores a pivotal point in its roadmap. Refocusing on the more potent 14A process could propel Intel past its own benchmarks and outperform its competitor, TSM. Investors often view such strategic choices as bold transitions that showcase market responsiveness to technological evolution.

Expert Perspective

As Tim Bohen, lead trainer with StocksToTrade says, “I focus on momentum that’s visible right now. Speculation on future moves is outside my playbook.” This approach is crucial for traders who aim to capitalize on market trends and make informed decisions based on current market dynamics, rather than relying on future predictions that may not materialize. In the fast-paced world of trading, having a solid understanding of the present market condition and reacting promptly is more effective than speculative strategies. Keeping a close eye on market momentum allows traders to seize opportunities as they unfold, aligning with Bohen’s emphasis on visible momentum.

Conclusion

Intel’s recent stock uptick offers traders a dose of confidence, but the ongoing saga of trade talks, along with internal strategic shifts, creates a complex web of potential ahead. Traders and markets must weigh the promise against numbers that hint at tighter corners and prudent fiscal troubleshooting. As Tim Bohen advises, “I never chase price. The best opportunities allow me to enter on my terms, not when I’m feeling pressured.”

Improved credit strategies and leaner operations may pave Intel’s road forward, but real gains depend on transformative engineering under new leadership. The days following July’s earnings release will be critical for insiders and shareholders alike. Whether market movements linger as temporal surges or herald steadfast stability hinges upon an intricate dance of strategy, market forces, and innovation.

Disclaimer: This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, with a focus on volatile sectors like penny stocks, AI stocks, Robinhood stocks, and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Leave a Reply