Rivian Automotive Inc. [NASDAQ: RIVN] is at a pivotal juncture, implementing strategic shifts to foster future growth. These changes include workforce reductions and a sharpened focus on efficiency as the company gears up to launch a new, more affordable SUV. Investors are keenly observing how these moves will impact Rivian’s financial trajectory and market position.

This article delves into Rivian’s recent financial performance, strategic decisions, and market outlook. We’ll analyze the company’s approach to balancing growth with profitability, its engagement with investors, and its expansion into universal charging networks. By examining these key areas, we aim to provide a comprehensive understanding of Rivian’s current state and its prospects for the future.

Key topics covered include Rivian’s workforce adjustments, participation in investor conferences, the expansion of its Adventure Network to non-Rivian EVs, and a detailed interpretation of recent financial reports. We will also explore the challenges Rivian faces in achieving profitability and the strategies it is employing to overcome these hurdles. Finally, we will provide a market outlook, considering Rivian’s competitive adaptability and stakeholder confidence.

Updates from Rivian Automotive

Rivian has been actively making strategic adjustments to prepare for future growth and enhance its market position. These updates provide insights into the company’s efforts to streamline operations, engage with investors, and expand its ecosystem.

- Rivian plans to reduce its workforce by less than 1.5% in the U.S. and Canada, aiming to cut costs before the launch of a new, budget-friendly SUV next year.

- Rivian participated in Morgan Stanley’s 13th Annual Laguna Conference, with CEO RJ Scaringe engaging in a fireside chat, highlighting the company’s connection with investors and commitment to electric vehicle innovation.

- The firm will be present at the Goldman Sachs Communacopia + Technology Conference to focus on zero-emission transportation efforts.

- Rivian is expanding its Adventure Network, welcoming non-Rivian electric vehicles, starting with the Joshua Tree Charging Outpost to support universal charging.

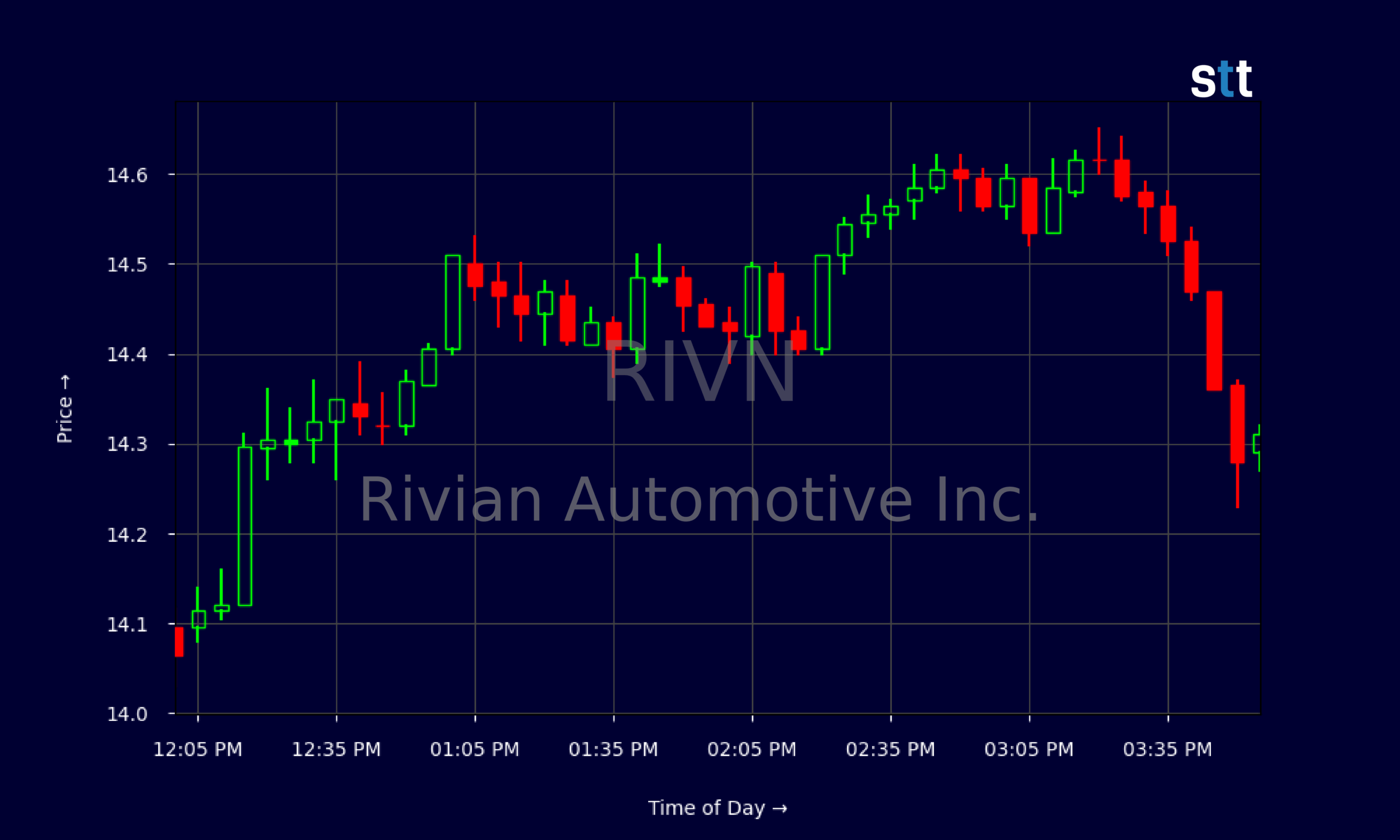

Financial Overview and Market Movements

Rivian’s financial statements and ratios present a mixed picture. While there is excitement surrounding the company’s innovation and growth plans, profitability margins remain a concern, with an EBIT margin of -65.1% and an EBITDA margin at -48.1%. These figures indicate that Rivian is facing significant challenges in achieving profitability.

The total revenue of $4.97B demonstrates promise, but it is largely overshadowed by a substantial net loss from continuing operations at $1.115B, underscoring the ongoing struggle to become profitable. Rivian’s decision to cut jobs and trim costs reflects its efforts to address these financial pressures in preparation for a new, more affordable sport utility vehicle.

In terms of asset turnover, Rivian’s standing at 0.3 suggests challenges in efficiently generating sales from its assets. However, the company’s cash reserves indicate a robust liquidity position, with a current ratio of 3.4. This provides the firm with sufficient short-term financial stability to meet obligations and handle unexpected events.

Rivian’s Financial Strategies and Challenges Ahead

Rivian is at a critical juncture, where strategic decisions will significantly influence its future. Management is implementing workforce reductions to streamline operations and reduce costs as the firm prepares to launch a more economical SUV. This strategy aligns with common industry practices of exchanging short-term pain for long-term gain.

Rivian has been actively engaging with investors through participation in renowned investor conferences, providing insights into future innovations. Maintaining a strong connection with investors while cultivating robust growth is essential. Rivian’s presence and engagement in investor circles enhance brand credibility and strengthen its broader financial ecosystem.

The move towards universal charging stations represents a strategic pivot aimed at fostering inclusivity and expanding market reach. Rivian’s Adventure Network and the newly opened Joshua Tree Charging Outpost demonstrate a vision of charging without boundaries. By embracing non-Rivian electric vehicles, the company opens doors to partnerships and promotes environmental stewardship, aligning with the growing zero-emission trends.

Interpretation of Recent Financial Reports

Rivian’s recent financial performance reveals both strengths and weaknesses. The total revenue of $1,303,000,000 for the quarter is overshadowed by total expenses of $2,417,000,000. This disparity highlights the operational challenges and the need to either reduce costs or increase revenue streams.

The balance sheet shows resilience with highly liquid assets, including significant cash reserves. Cash flow statements support this resilience, indicating inflows from financing activities and a promising end cash position leading into future quarters.

A key part of Rivian’s strategy is to reinforce brand identity through engagement and participation in technology-driven conferences, showcasing a vigorous research and development program. The projections surrounding zero-emission technologies continue to resonate with global policies, indirectly aligning with sustainable investment strategies.

Conclusion and Market Outlook

Strategic maneuvers and insightful participation at investor forums bring invaluable advantages to Rivian. The pursuit of universal EV charging channels resonates with visionaries focused on inclusive growth. However, financial margins remain a significant concern, underscoring the need for diligence in operational and administrative efficiency.

Rivian’s future hinges not only on its electric mobility promise but also on its ability to navigate challenging financial terrains. As fiscal reports suggest a push beyond current limitations, Rivian’s success in achieving market upswing depends on its strategies, stakeholder confidence, and competitive adaptability. Traders are weighing immediate cuts and prolonged innovations against potential future profits. Rivian’s journey continues to attract market attention, with anticipation of future developments.

This is stock news, not investment advice. StocksToTrade News delivers real-time stock market updates tailored to highlight the key catalysts driving short-term price movements. Our coverage is designed for active traders and investors who thrive in fast-moving markets, focusing on volatile sectors like penny stocks, AI stocks, Robinhood stocks, and other momentum plays. From earnings reports and FDA approvals to mergers, new contracts, and unusual trading volume, we break down the events that can spark significant price action.

Looking to level up your trading game? Explore StocksToTrade, the ultimate platform for traders. With powerful tools designed for swing and day trading, integrated news scanning, and even social media monitoring, StocksToTrade keeps you one step ahead.

Check out our quick startup guide for new traders!

Ready to build your watchlists? Check out these curated lists:

Once your watchlist is set, take the next step and trade with confidence using StocksToTrade’s robust platform. Don’t miss out — grab your StocksToTrade trial and experience the edge you need to thrive in today’s fast-paced markets.

Leave a Reply