The media landscape is constantly evolving, and one of the biggest potential shifts on the horizon is a possible merger between Warner Bros. Discovery and Paramount Global. This deal could reshape the entertainment industry, creating a behemoth to rival streaming giants like Netflix and Disney. With both companies acknowledging discussions, it’s crucial to examine the potential impact of such a merger.

This article dives deep into what a combined Warner Bros.-Paramount entity would own, from blockbuster film franchises like Harry Potter and Mission: Impossible to streaming services like HBO Max and Paramount+, and news networks like CNN and CBS News. We will explore the potential benefits and drawbacks of this merger, analyzing how it could affect competition, content creation, and the future of media consumption.

Let’s explore the implications for film, streaming, news, and cable, offering a clear picture of the media landscape should this deal come to fruition.

Film Franchises: A Century of Storytelling

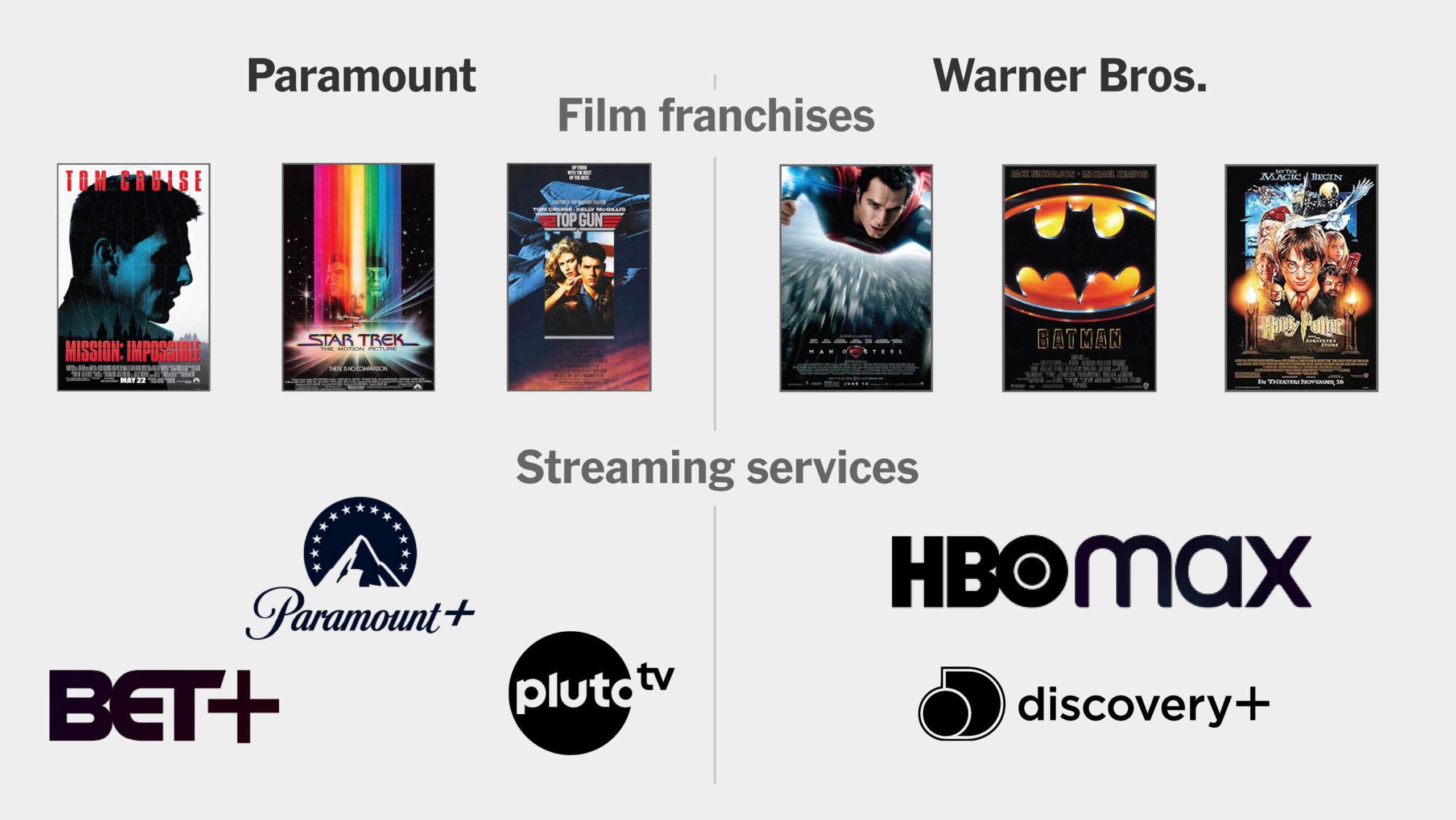

A merger between Paramount and Warner Bros. would unite an impressive array of film franchises, bringing together over a century of cinematic storytelling. Paramount, known for its action-packed hits and classic films, owns iconic franchises such as Mission: Impossible and Star Trek. Warner Bros., on the other hand, boasts comic book heroes like Batman and the magical world of Harry Potter.

Paramount’s Key Film Franchises:

- Mission: Impossible: This action franchise has grossed $1.5 billion lifetime.

- Star Trek: With a dedicated fan base, this franchise has earned $1.4 billion.

- Top Gun: The recent sequel boosted this franchise to $899 million.

Warner Bros.’s Prestigious Properties:

- DC Universe: Featuring iconic superheroes, this universe has grossed $2.8 billion.

- Batman: As one of the most recognizable characters, Batman has grossed $2.8 billion.

- Harry Potter: This beloved franchise has earned $2.4 billion.

Combining these franchises could lead to exciting new projects and shared universes. However, it might also reduce competition for new productions and trigger substantial cost-cutting measures.

Streaming Services: Competing with the Giants

Both Paramount and Warner Bros. are striving to compete with streaming giants like Netflix and Disney. Paramount has a trio of streaming services, while Warner Bros. is heavily invested in HBO Max.

Paramount’s Streaming Strategy:

- Paramount+: Boasting 77.7 million paid subscribers.

- BET+: A streaming service focused on Black culture.

- Pluto TV: A popular ad-supported streaming service.

Warner Bros.’s Streaming Strategy:

- HBO Max: A flagship streaming service with a vast library.

- Discovery+: Together HBO Max and Discovery+ have 125.7 million paid subscribers.

A merger could allow these companies to spread their content costs across a broader subscriber base, potentially improving profitability. However, challenges in integrating different streaming platforms and content libraries would need to be addressed.

News Networks: A Powerful Combination

If Warner Bros. Discovery and Paramount Global merge, their news networks, CNN and CBS News, would combine. This could create a news powerhouse but also raises questions about cost-cutting and editorial oversight.

CBS News:

- Home to “60 Minutes,” a highly popular news program.

CNN:

- Known for breaking news and international coverage.

A combined CNN and CBS News could lead to significant synergies in newsgathering and production. The company would need to navigate potential overlaps and maintain distinct editorial identities to avoid alienating viewers.

Basic Cable: Navigating a Declining Landscape

Both Paramount and Warner Bros. own a variety of basic cable networks. Paramount’s include MTV, Nickelodeon, and Comedy Central, while Warner Bros. owns TNT, HGTV, and TBS.

Paramount’s Cable Networks:

- MTV: Averaging 129,827 primetime viewers in 2025.

- Comedy Central: Averaging 148,752 primetime viewers in 2025.

- Nickelodeon: A prominent children’s network.

Warner Bros.’s Cable Networks:

- TNT: Averaging 683,528 primetime viewers in 2025.

- HGTV: Averaging 557,386 primetime viewers in 2025.

- TBS: Averaging 502,174 primetime viewers in 2025.

As traditional cable viewership declines, these networks face challenges. The merger could allow for strategic bundling and content sharing, but also potential network spin-offs to streamline operations.

Final Thoughts: The Future of Media?

A potential merger between Warner Bros. Discovery and Paramount Global could reshape the media landscape, creating a new entertainment giant. The combined entity would own a vast array of film franchises, streaming services, news networks, and cable channels. The deal has the potential to create a powerhouse with the ability to compete with streaming giants, though many challenges will arise.

The success of the merged company would depend on how well it integrates its diverse assets, manages potential overlaps, and adapts to the evolving media consumption habits of viewers. As the entertainment industry continues to transform, this merger could be a defining moment, setting the stage for new strategies and competitive dynamics.

Whether the merger leads to greater innovation, better content, or just more consolidation remains to be seen, but the implications will undoubtedly be far-reaching and transformative.

Leave a Reply