The debate over tariffs continues to be a hot topic, especially as they relate to the economy and trade relations. In a recent discussion, Treasury Secretary Scott Bessent firmly stated his position that tariffs are not a tax. He challenged Democrats who are worried about tariffs causing inflation to work with him to lower taxes, which he believes would reduce inflation. This stance highlights the ongoing disagreements about the effect of tariffs on the U.S. economy and their role in international trade.

In this article, we will examine Bessent’s arguments, the potential effects of tariffs, and the larger discussion surrounding trade policies. We will analyze whether tariffs should be considered a tax, how they affect consumers and businesses, and their place in the Trump administration’s economic strategy.

Scott Bessent’s Defense of Tariffs

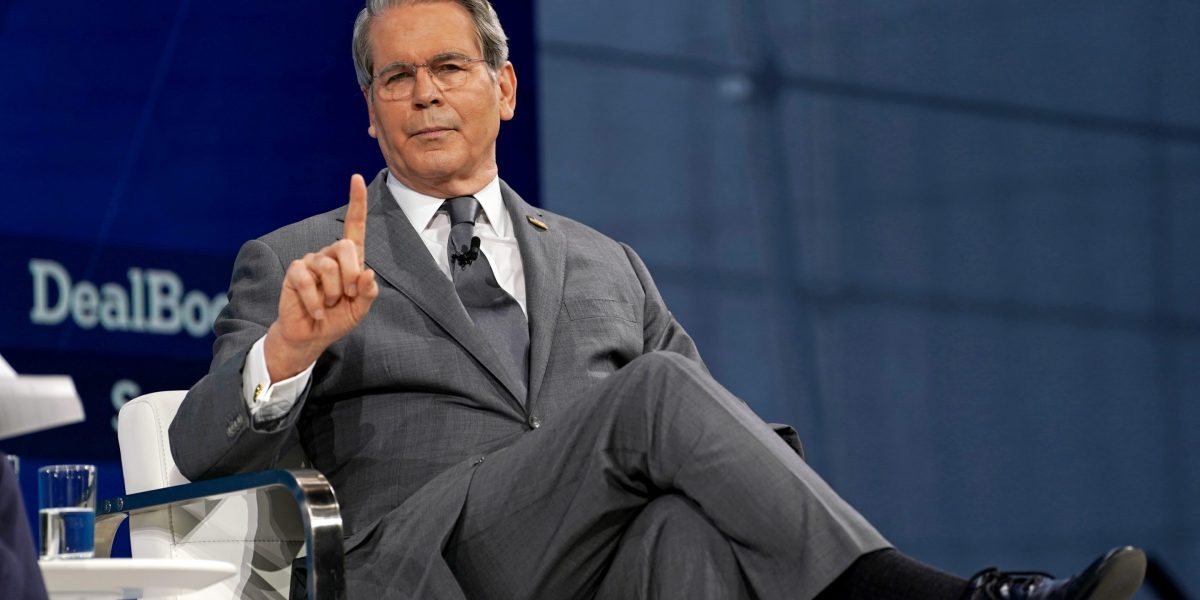

Scott Bessent made a strong argument in favor of tariffs at the New York Times’ DealBook Summit, claiming that they are not a tax. He said that many Democrats secretly support tariffs but cannot say so because they are linked to Trump. Bessent also baited some Democrats into agreeing that tariffs act as a tax, then used their logic to suggest they should support tax cuts to fight inflation. According to Bessent, tariffs are bringing in a lot of money and are “good for labor,” but he admitted they are becoming less important over time. The main goal, he stressed, is to rebalance trade and bring production back to the United States.

Tariffs vs. Taxes: An Economic Quandary

The issue of whether tariffs are a tax is complicated. Tariffs are paid by American companies and consumers and are often hard to tell apart from a tax. There are claims that they have increased inflation, which was decreasing when Trump was reelected. Tariffs are part of a long-standing trade issue with China. However, the Trump administration has stood by them, even though they are not working as originally planned. As Fortune reported in November 2025, economists at UBS suggested tariffs could trigger a recession. The debate over tariffs and their economic impact continues to evolve.

The Revenue Debate and Economic Impact

While tariffs are generating revenue, Bessent noted that this is not their main goal. He described tariffs as a “shrinking ice cube,” recognizing that the revenue generated is less than initially projected. Multiple economists have supported this view, highlighting that tariffs’ impact on deficit reduction has been less than expected. The primary aim is to rebalance trade and encourage domestic production. The discussion includes the long-term economic effects and whether the benefits outweigh the costs.

Tariffs and Inflationary Pressures

Bessent addressed worries that tariffs are causing inflation. He defined inflation as a “generalized price and persistent price increase,” arguing that tariffs are a one-time price adjustment, not inflation. However, Andrew Ross Sorkin pointed out that Bank of America found tariffs have increased consumer prices. Federal Reserve Chair Jerome Powell also noted that inflation, excluding tariffs, is close to the 2% target. Bessent countered by saying tariffs are a small part of the economy, dismissing concerns as Democratic talking points. The disagreement centers on the extent to which tariffs affect overall inflation and consumer prices.

Countering China: A Central Strategy

Bessent emphasized that a key part of the administration’s strategy is countering China, which he described as a “very different economic animal.” He pointed out China’s willingness to “subsidize labor, subsidize production, [and] subsidize capital” to maintain its export economy. According to Bessent, tariffs offer essential emergency leverage. He mentioned that when Trump threatened China with a 100% tariff due to export licensing requirements, China quickly came to the negotiating table. This highlights the use of tariffs as a tool to address trade imbalances and unfair trade practices.

The Supreme Court and the Future of Tariffs

Looking ahead to the Supreme Court ruling on tariffs, Bessent expressed optimism but acknowledged concerns about a potential loss for the administration. He warned that if the administration loses the legal fight, it “will be a loss for the American people.” He suggested that even if the current tariffs are struck down, the administration has ways to maintain the structure. Bessent also disputed mainstream media interpretations of Justice Amy Coney Barrett’s remarks, arguing she meant the court needed to be “very judicious” and “very prudent.” The ruling will likely have a significant impact on the future of trade policy.

Conclusion: Tariffs, Taxes, and Trade Policy

The discussion over whether tariffs are a tax is complex, with strong opinions on both sides. Scott Bessent’s defense of tariffs highlights the Trump administration’s strategy to use them as a tool to rebalance trade and counter unfair practices. While opponents argue that tariffs increase inflation and harm consumers, supporters maintain that they are essential for protecting domestic industries and encouraging economic growth. The ongoing debate and future Supreme Court ruling will continue to shape the future of trade policy and its impact on the U.S. economy.

Leave a Reply