BP (British Petroleum) is a multinational energy company with a significant presence on the London Stock Exchange (LSE). Recent trading sessions have shown volatility in BP’s stock (BP.), prompting investors to question its stability. While daily fluctuations can be concerning, a broader perspective reveals encouraging trends and long-term value.

This analysis delves into BP’s recent stock performance, examining its daily movements, monthly gains, and overall historical returns. We’ll address frequently asked questions to provide clarity for investors seeking to understand BP’s position in the energy market and its future prospects. By looking beyond short-term volatility, we aim to offer a comprehensive view of BP’s stock as a potential long-term investment.

This article explores BP’s daily stock performance, its monthly gains showcasing resilience, the long-term value proposition, and answers frequently asked questions (FAQs) about BP stock. Understanding these aspects helps investors make informed decisions.

BP Stock: Navigating Daily Fluctuations

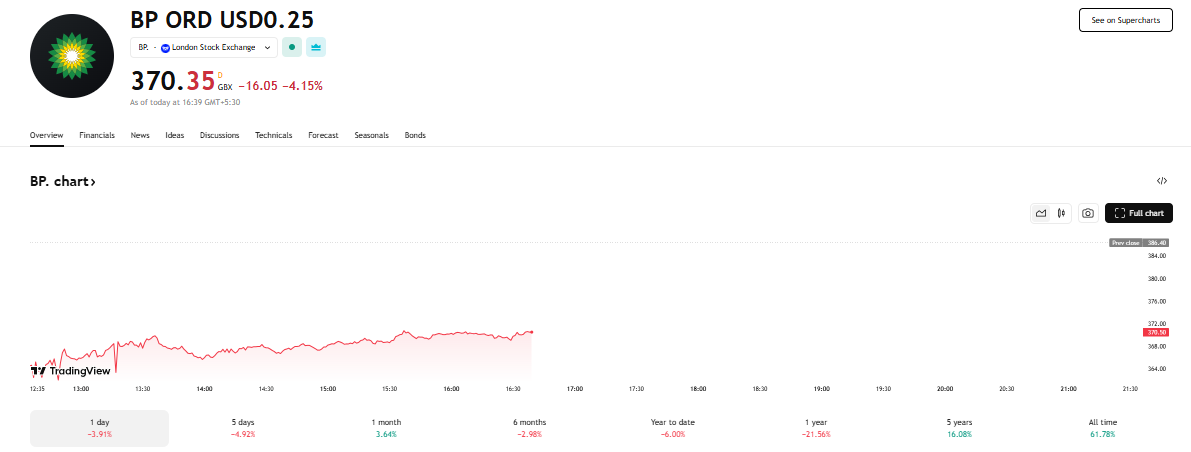

On a recent trading day, BP’s stock closed at 370.35 GBX (Pence Sterling) on the London Stock Exchange. The stock experienced a decline of 16.05 pence, equivalent to a 4.15% decrease. This drop occurred amidst broader volatility affecting the energy markets, influenced by factors such as fluctuating oil prices and geopolitical events. Daily volatility is a common characteristic of stock markets, reflecting immediate reactions to news and market sentiment.

However, it’s important not to overemphasize single-day movements. According to market analysts, focusing solely on daily changes can obscure underlying trends and long-term value. While a 4.15% decline might appear significant, it’s crucial to contextualize this within BP’s overall performance and the broader market environment.

Investors should be wary of making impulsive decisions based on daily fluctuations. Instead, a comprehensive analysis should consider multiple factors, including monthly performance, historical returns, and the company’s strategic direction. This approach provides a more balanced view of BP’s investment potential.

Monthly Gains: A Sign of Resilience

Looking beyond the daily volatility, BP’s stock demonstrates resilience with positive returns over the past month. The stock has delivered a gain of 3.64%, indicating renewed investor confidence and underlying strength. This upward trend provides a contrasting perspective to the short-term fluctuations, suggesting that BP is weathering market uncertainties.

This monthly gain reflects investor recognition of BP’s long-term strategy and its commitment to transitioning towards a lower-carbon future. Market data suggests that investors are increasingly valuing companies with sustainable practices, which could be contributing to BP’s positive monthly performance.

Investors looking for stability in the energy sector may find BP’s recent monthly gains encouraging. It indicates the company’s ability to navigate market complexities and generate positive returns. These trends help investors to mitigate risks and make informed decisions.

The Long-Term Perspective: A Foundation of Value

To truly understand BP’s strength, consider its long-term performance. Over the past five years, BP stock has provided investors with a solid return of 16.08%. Since its listing, the stock has generated an overall return of 61.78%, underscoring its enduring presence in the global energy sector. These figures demonstrate BP’s ability to navigate market cycles and deliver returns consistently.

Financial analysts emphasize the importance of assessing a company’s long-term track record. BP’s historical performance indicates its resilience and ability to adapt to changing market conditions. This perspective is particularly relevant for value-oriented investors who prioritize stability and consistent returns.

BP’s commitment to transitioning towards renewable energy sources adds to its long-term value proposition. As the world moves towards a lower-carbon economy, BP’s investments in sustainable energy position it as a forward-thinking company capable of meeting future energy demands. Investors are increasingly viewing BP as an evolving energy company ready to provide stability for decades to come.

Frequently Asked Questions (FAQ) about BP plc (BP.)

Here are detailed answers to common questions regarding BP and its stock performance.

- What is the stock ticker for BP plc on the London Stock Exchange?BP’s primary listing on the London Stock Exchange trades under the ticker symbol BP. (with a period).

- What was the closing price of BP stock today?As of the latest report, the price of BP stock was 370.35 GBX.

- What does GBX stand for?GBX stands for Great British Pence. It means the stock price is listed in pence, not pounds. So, 370.35 GBX is equivalent to £3.7035.

- How did BP stock perform in today’s trading session?The stock experienced a significant decline of 16.05 pence, which represents a loss of -4.15% for the day.

- How has the stock performed over the last month?Looking at a slightly longer timeframe, the stock has shown positive momentum, with a gain of 3.64% over the last month.

- What is the 5-year return for BP investors?Over a five-year period, the stock has provided a positive return of 16.08%.

- What is the all-time return for BP stock?Since its inception, the stock has generated a total return of 61.78% for long-term shareholders.

- How has the stock performed over the last year?The last year has been challenging for the stock, showing a decline of -21.56%.

- What does “BP ORD USD0.25” mean?This refers to the security type. “ORD” stands for Ordinary shares, which are the most common type of stock. “USD0.25” indicates the nominal or par value of each share is $0.25 (US Dollars), even though the stock trades on the LSE in Pence Sterling (GBX).

- What was the previous closing price for BP stock?The stock’s previous closing price was 386.40 GBX.

- What is the year-to-date (YTD) performance of BP stock?Since the beginning of the year, the BP stock has declined by -6.00%.

- What does BP do?BP plc is a British multinational integrated oil and gas company. Its operations cover the entire energy value chain, from exploration and production of oil and gas to refining, marketing, power generation, and trading. The company is also making significant investments in renewable energy as part of its transition strategy.

Conclusion

In conclusion, while BP’s stock (BP.) experiences daily volatility, a review of its monthly gains and long-term performance reveals a more stable and resilient investment. The recent daily decline of 4.15% is offset by a monthly gain of 3.64%, showcasing underlying strength. Over the past five years, BP has provided a return of 16.08%, and since its listing, it has generated an overall return of 61.78%.

These metrics, combined with BP’s strategic shift towards renewable energy, position it as a valuable consideration for long-term, value-oriented investors. The ability to look past daily market fluctuations and consider the broader picture is essential for identifying opportunities in foundational companies like BP.

Therefore, investors should consider BP’s long-term strategies, historical performance, and commitment to renewable energy when evaluating its stock. While short-term volatility is unavoidable, BP’s underlying strength and long-term vision make it a potentially attractive option for those seeking stability and growth in the energy sector.

Leave a Reply