Oracle, a name synonymous with database technology, has quietly transformed into a key player in the AI infrastructure landscape. Investors might have initially overlooked Oracle, but its stock performance tells a different story. Over the past three years, Oracle has not only outperformed the S&P 500 and Nasdaq Composite but has also surpassed leading tech giants. This article delves into whether Oracle stock presents a compelling investment opportunity in today’s AI-driven market.

We’ll analyze Oracle’s recent financial performance, particularly its growth in cloud services and the factors driving its revenue. Furthermore, we will evaluate the risks associated with investing in Oracle, including its heavy spending on data center expansion and potential impacts from an AI spending slowdown. Finally, we will discuss the stock’s valuation and provide a comprehensive assessment of whether Oracle stock is a buy now.

Oracle’s Impressive Performance

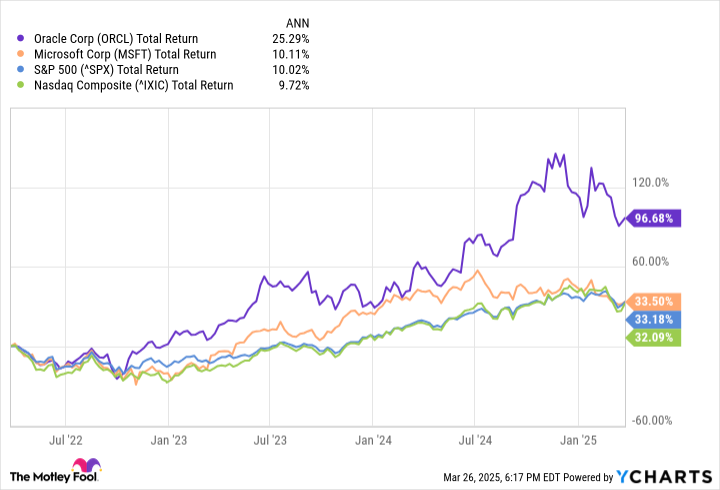

Oracle has delivered substantial returns to its investors, showcasing its ability to thrive in the age of AI. While Microsoft’s shares have generated a total return of 34% over the last three years, mirroring the performance of the S&P 500 and Nasdaq Composite, Oracle has surged ahead with a remarkable total return of 97%. This outperformance has caught the attention of investors seeking opportunities beyond the commonly recognized AI frontrunners.

This growth has made Oracle an under-the-radar player within the AI sector. Oracle has strategically positioned itself to capitalize on the growing demand for AI infrastructure, making it a compelling option for investors bullish on the long-term growth of AI. As more businesses adopt AI solutions, Oracle’s role in providing essential infrastructure is likely to expand.

The AI Infrastructure Demand

The primary catalyst behind Oracle’s impressive rally is the surging demand for AI infrastructure. As businesses increasingly adopt AI technologies, the need for robust and scalable infrastructure has grown exponentially. Oracle, as a leading provider of data center servers and cloud services, is well-positioned to benefit from this trend. Its expertise in managing and delivering large-scale data solutions makes it an ideal partner for companies seeking to deploy AI applications.

Oracle’s cloud services revenue jumped by 23% to $6.2 billion, representing nearly 44% of its total revenue. This growth highlights Oracle’s successful transition to a cloud-based business model and its ability to capture a significant share of the expanding cloud market. The company’s focus on providing cutting-edge server technology and cloud infrastructure has enabled it to attract major players in the AI space, further solidifying its position as a key enabler of AI innovation.

Future Growth Catalysts

Oracle holds a significant sales backlog, fueled by signed sales contracts with industry giants such as Meta Platforms, Nvidia, AMD, OpenAI, and xAI. These partnerships are poised to drive substantial revenue expansion in 2025 and beyond. Oracle’s ability to secure contracts with these leading AI innovators underscores its technological capabilities and its reputation as a trusted provider of AI infrastructure.

The joint venture between OpenAI, SoftBank, and Oracle, known as Stargate, is expected to further boost demand for AI training and inference. The initiative plans to invest up to $500 billion in constructing as many as 20 large AI data centers in the U.S. by 2029. This ambitious project signals a long-term commitment to expanding AI infrastructure and positions Oracle as a central player in supporting the future growth of AI technologies.

Potential Risks to Consider

Despite the promising outlook, investing in Oracle carries inherent risks. The company is making substantial investments to expand its data center network, leading to a dip in free cash flow even as revenue and net income increase. Investors should closely monitor Oracle’s cash flow generation to ensure it can sustain its growth investments and meet its financial obligations. Effective financial management will be critical to maintaining investor confidence and supporting long-term value creation.

A slowdown or pullback in AI spending by major players could significantly impact Oracle’s growth trajectory. With revenue growing at a 6% annual clip, the company has limited buffer to absorb any potential deceleration. Diversifying its revenue streams and focusing on operational efficiency can help mitigate this risk. Moreover, Oracle’s ability to adapt to changing market conditions will be essential for sustaining its growth momentum.

Valuation and Market Sentiment

Oracle’s valuation offers a mixed perspective. As of this writing, its trailing 12-month price-to-earnings (P/E) ratio stands at 36, down significantly from its recent three-year high of nearly 50. Its current P/E is only slightly above its three-year average of 34, suggesting that the stock may not be overvalued relative to its historical performance. Investors should compare Oracle’s valuation metrics with those of its peers to gain a comprehensive understanding of its relative attractiveness.

Despite the volatility inherent in growth stocks, Oracle presents a compelling investment case for those who believe in the long-term potential of AI. With its strong position in data center infrastructure and its strategic partnerships with leading AI innovators, Oracle is well-positioned to capitalize on the expanding AI market. However, investors should carefully weigh the risks and monitor the company’s financial performance to make informed investment decisions.

Final Thoughts

Oracle has emerged as a notable under-the-radar player in the AI stock space, offering investors a unique opportunity to participate in the growth of AI infrastructure. The company’s strategic focus on providing data center servers and cloud services has positioned it as a key enabler of AI innovation. However, investors should carefully consider the risks associated with investing in Oracle, including its heavy spending on data center expansion and potential impacts from an AI spending slowdown.

For investors who believe in the long-term growth story behind AI data center demand, Oracle could be a worthwhile addition to their portfolios. However, a thorough analysis of the company’s financial performance, valuation, and competitive positioning is essential. Ultimately, the decision to invest in Oracle should align with individual investment goals and risk tolerance. By carefully weighing the opportunities and risks, investors can make informed choices and potentially benefit from Oracle’s continued growth in the AI era.

Leave a Reply